REDSTONE (LSE:RED)

- COMPANY VALUE AT FIRST INVESTMENT

- MARKET CAP AT DEMERGER

- MXC INVESTMENT QUANTUM*

- MXC VALUE OF HOLDING AT DEMERGER

- MONEY MULTIPLE

- IRR

- *shares bought and sold on various occasions

Business Activity

Infrastructure and related IT service offerings including wide-area network services.

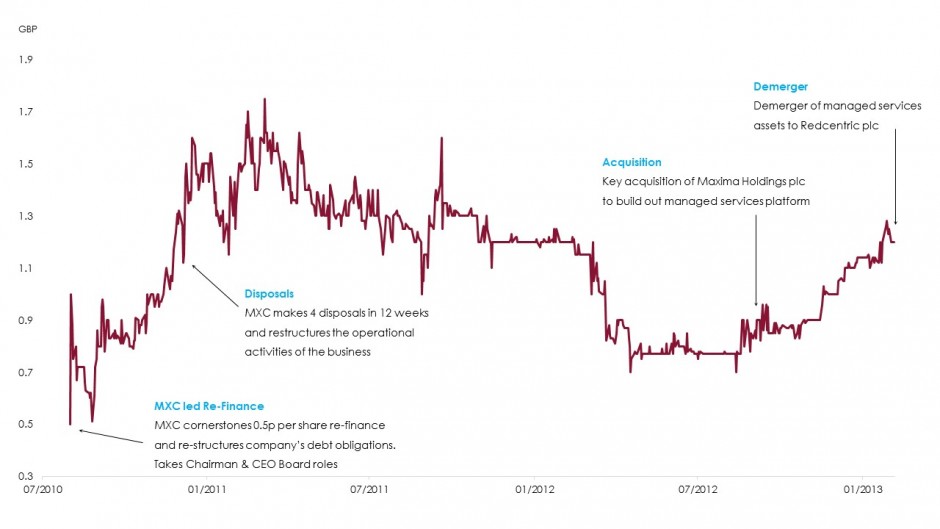

Opportunity Identified

In August 2010 Redstone required re-financing to prevent administration following a failed fundraising. Invited by Gartmore, MXC identified core assets within Redstone that represented value to build from.

MXC Role

- Reduced headcount from 800 to 442 staff in 12 weeks

- Completed 4 disposals

- De-levered the balance sheet using proceeds from disposals

- Split the business into 2 divisions and acquired Maxima Holdings plc

- Raised additional £20m to effect its transformation

Outcome

In April 2013 Redstone demerged the managed services business into Redcentric plc. In November 2013 Redstone sold its infrastructure business to Coms plc and was renamed Castleton Technology plc.